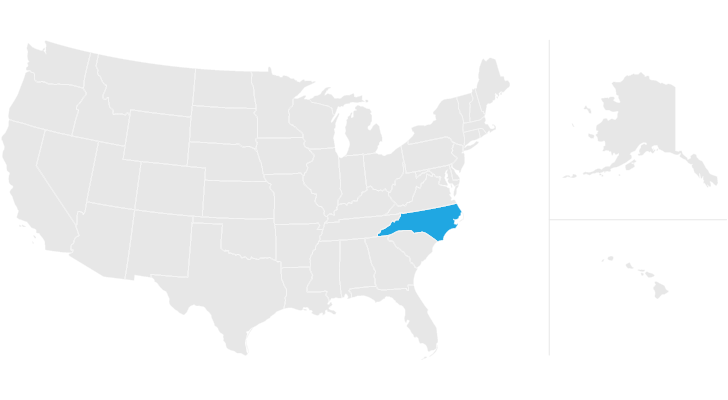

north carolina estate tax 2021

However now that North Carolina has eliminated its estate tax most wealthy North Carolina residents will owe estate taxes only to the federal government. Note that even if youre a resident of North Carolina if you inherit property from another state that state may have an estate tax that applies.

Default Property Inspections In 2021 House Prices House Valuations Australian Homes

Federal Estate Tax Death Tax Only estates exceeding 114 million.

. Link is external 2021. North Carolina Department of Revenue. Application for Extension for Filing Estate or Trust Tax Return.

North Carolina Property Taxes 2021 Go To Different State Lowest Property Tax Highest Property Tax No Tax Data North Carolina Property Taxes Go To Different State 120900 Avg. NC K-1 Supplemental Schedule. Literacy tests were banned by brainly.

2021 is a revaluation year in Forsyth County. The tax basis is the gross value of an entire estate including half of the value of property owned with someone else. The District of Columbia moved in the.

The last day to. Individual income tax refund inquiries. When ownership in North Carolina real estate is transferred an excise tax of 1 per 500 is levied on the value of the property.

The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020. North Carolina state income tax Form D-400 must be postmarked by April 18 2022 in order to avoid penalties and late fees. The current Federal Estate Tax Exemption for 2021 is 117 million per individual.

Skip to main content Menu. Ghost justin bieber chords ukulele. North Carolina Department of Revenue.

This form is for income earned in tax year 2021 with tax returns due in April 2022. PO Box 25000 Raleigh NC 27640-0640. For example a 600 transfer tax would be imposed on the sale of a 300000 home.

For Tax Year 2019 For Tax. File image of tax forms leezsnow Getty Images. Funny gifts for cigarette smokers.

However state residents should keep federal estate taxes in mind if their estate or the estate they are inheriting is worth more than 1206 million in 2022. The federal estate tax exemption is 1206 million in 2022 so only estates larger than that amount will owe federal estate taxes. The state income tax rate is.

See below for a chart of historical Federal estate tax exemption amounts and tax rates. North carolina estate tax exemption 2021Karina Al Zubi. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020. Property Left to the Surviving Spouse. How Much Are Transfer Taxes in North Carolina.

North carolina estate tax exemption 2021. Forsyth County typically revalues property every four years and the last cycle was in 2017. The tax rate on funds in excess of the exemption amount is 40.

The marital deduction allows property and assets left to the spouse to be exempt from the federal estate tax. The state of North Carolina offers a standard deduction for taxpayers. Download or print the 2021 North Carolina Form D-410P Application for Extension for Filing Partnership Estate or Trust Tax Return for FREE from the North Carolina Department of Revenue.

The North Carolina State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 North Carolina State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. Beneficiarys Share of North Carolina Income Adjustments and Credits. The North Carolina income tax rate for tax year 2021 is 525.

New values will be established for all real estate parcels in the county effective as of January 1 2021. We will update this page with a new version of the form for 2023 as soon as it is made available by the North Carolina government. During the Houses June 16 meeting Szoka estimated that eliminating the pension taxation for military retirees would have a revenue decrease of.

Printable North Carolina state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021. The North Carolina Department of Revenue is responsible. 105-321 - Repealed by Session Laws 2013-316 s7 a effective January 1 2013 and applicable to the estates of decedents dying on or after that date.

If youre scrambling to file your taxes youre not alone. 2 days agoApril 18 2022 256 PM. 078 of home value Tax amount varies by county The median property tax in North Carolina is 120900 per year for a home worth the median value of 15550000.

After Aunt Ruths estate deducts the exemption she would only owe gift and estate taxes on the remaining 155 million taxed at the rate of 40 percent. Starting in 2022 the exclusion amount will increase annually based on. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

Home File Pay Taxes Forms Taxes Forms. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. The 2021 standard deduction allows taxpayers to reduce their taxable income by 10750 for single filers 21500 for married.

Owner or Beneficiarys Share of NC. For the year 2016 the lifetime exemption amount is 545 million. Seven counties in North.

Box 25000 Raleigh NC 27640-0635 Application for Extension for Filing Partnership Estate or Trust Tax Return North Carolina Department of. Any federal or state gift and estate tax due however is paid by the estate during the probate of the estate. We last updated North Carolina Form D-410P in February 2022 from the North Carolina Department of Revenue.

2021 North Carolina General Statutes Chapter 105 - Taxation Article 1A - Estate Taxes. If a property owner believes that the value is overstated on the revaluation notice it is to the property. Transfer taxes in North Carolina are typically paid by the seller.

The current Federal Estate Tax Exemption for 2021 is 117 million per individual.

Janice L Nichols North Carolina Real Estate Bhhs Carolinas Realty In 2021 North Carolina Real Estate Real Estate Website Coastal Carolina University

2015 Taxes Are Due Now Accounting Principles Financial Statement Financial Accounting

Annual Pass Annual Pass Biltmore Biltmore Estate Asheville

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

North Carolina Estate Tax Everything You Need To Know Smartasset

Planting Fields Foundation Public Garden Planting Fields Arboretum Plants

Asset Protection In North Carolina What Can You Do To Protect Your Assets From Your Creditors Creditors Estate Planning Asset

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel

Pin By Susan Herrmann On Retirement In 2022 Order Of Operations Estate Planning Federal Income Tax

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Estate Tax Everything You Need To Know Smartasset

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

For Her Sister S Charlotte North Carolina Home Atlanta Designer Carter Kay Used Masterful Color Combinati House And Home Magazine Southern Home Starter Home

Pin By Courtney Bear Sistrunk On Architecture In 2021 Estate Homes Stucco Exterior Real Estate

Irs Tax Problems Irs Taxes Tax Debt Debt Relief

2015 Taxes Are Due Now Accounting Principles Financial Statement Financial Accounting

Pin By Reg Davies On Taxes Charlotte Nc Filing Taxes Identity Theft Tax Return