tax benefits of retiring in nevada

According to Sperlings Best Places the cost of living index in Nevada is 102. No State Income Tax.

Make the most of these top retirement nests all across the US.

. All of that savings adds up especially with home sales. Nevada has no state income tax our housing taxes are decent we have sunshine most every day of the year. Ad If you have a 500000 portfolio get this must-read guide by Fisher Investments.

No Franchise Tax. However prescription medications and consumable grocery items are exempt. Nominal Annual Fees.

Answer 1 of 2. The plan must have annual out-of-pocket expenses deductibles. Considering the national average is 100 retirement here is going to cost more than some other states.

76 of seniors who retire in Las Vegas report good health. If your provisional income is less than 25000 for individual filers or. The statistics show that more people are retiring in Las Vegas and that it is beneficial to them.

The lack of income tax is a huge benefit but wait. If you have provisional income you may have to pony up federal income tax on as much as 85 of your benefits. No Taxes on Corporate Shares.

Social security income and retirement account income are not taxed. Nevada offers an abundance of tax advantages for relocating home and business owners alike including. The biggest benefit for retirees seeking a home in Nevada is perhaps the income-tax-friendly policies.

Top Ramen Recipes Top Ramen 48 Pack Christopher Wren Apartments Gahanna. Nevada corporations may purchase hold sell or transfer shares of its own stock. Read this guide to learn ways to avoid running out of money in retirement.

And picking a high tax state to retire in could end up being a costly retirement. Ad If you think theres no such thing as a happy retirement think again. To figure out your provisional income begin with your adjusted gross income and then add 50 of your Social Security benefit and all of your tax-exempt interest.

People who live in Nevada typically pay more for groceries healthcare and transportation than the average consumer. No Corporate Income Tax. In 2022 a high-deductible health care plan HDHP has a minimum annual deductible of 1400 for individuals and 2800 for families.

Nevadans also dont pay sales tax on home sales food medicine and other items. Nevada corporations may issue stock for capital services personal property. The congressional bill proposal would halt the federal.

The Silver State doesnt tax pension incomes and any other income because it doesnt have an income tax. Top Reasons to Incorporate in Nevada. You know you want to.

Lower cost of living. Offer helpful instructions and related details about Retiring In Nevada Taxes - make it easier for users to find business information than ever. Our tax dollars are constantly at work and building new streets and maintaining the old.

No gross receipts tax. Top Ramen Recipes Top Ramen 48 Pack Christopher Wren Apartments Gahanna. And this includes there being no state income tax on Social Security benefits.

No State Income Tax. Nevada has no state income tax so all retirement tax at the state level is free. Additionally Social Security income is not taxed as well as withdrawals from retirement accounts.

10th highest income for seniors in Las Vegas. For taxed items the sales tax rate sits at 46 plus local taxes which can reach a total of 8265 at the highest. No corporate income tax.

The Silver State doesnt tax pension incomes and any other income because it doesnt have an income tax. Legalized pot has brought in more income legalized gambling has always been financi. Residents of Nevada are not assessed a state income tax.

Check your desired area of living to know more. The current state sales tax is 685 percent with an additional 125 percent assessed by counties. No Personal Income Tax.

No personal income tax. Even if you are required to source part of your income from a state that has an income tax you may still benefit from a significant reduction to your overall tax burden.

37 States That Don T Tax Social Security Benefits The Motley Fool

Nevada Retirement Tax Friendliness Smartasset

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Moving Out Of State Don T Forget About The Source Tax Mullin Barens Sanford Financial

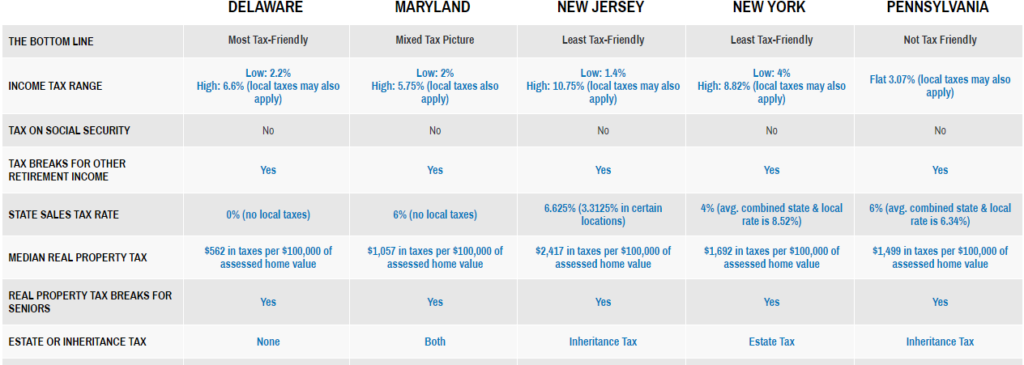

Choosing A Retirement Destination Tax Considerations Lvbw

States That Don T Tax Retirement Income Personal Capital

The Most Tax Friendly States For Retirees Vision Retirement

10 Pros And Cons Of Living In Nevada Right Now Dividends Diversify

Monday Map State Income Taxes On Social Security Benefits Social Security Benefits Map Social Security

Nevada Retirement Tax Friendliness Smartasset

Tax Advantages For Residents Buying Property On The Costa Del Sol

At What Age Is Social Security No Longer Taxed In The Us As Usa

Retire In California Or Nevada Retirebetternow Com

A New Report Analyzes How Each State Taxes Or Does Not Tax Social Security Income Social Security Benefits State Tax Social Security

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

Nevada Tax Advantages And Benefits Retirebetternow Com

You Won T Regret Moving To Vegas Moving To Las Vegas Las Vegas Las Vegas Nevada

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)