nebraska inheritance tax worksheet

For more information on Nebraska inheritance tax check the Nebraska. Close relatives of the deceased person are given a 40000 exemption from the state inheritance tax.

Matthew Wurstner On Nebraska S Inheritance Tax And Why You Should Care About It 91 5 Kios Fm

With DocHub making changes to your documentation takes only a few simple clicks.

. In other words they dont. La Licence I Fish Act To Future A Of. Record of income tax will respond to douglas county nebraska inheritance tax worksheet tax commissioner may be.

On a statewide basis the inheritance tax collections have ranged from 189 to 733 million since 1993 337 to 745 million if adjusted for inflation into 2020 dollars. Lic System Request Nebraska Probate Form 500 Inheritance Tax Fill and Sign. To start with look for the Get Form button and tap it.

How to Edit and fill out Nebraska Inheritance Tax Worksheet Online. 201 rows Certificate of Mailing a Notice of Filing a Petition For The Determination of Inheritance Tax. Open the template in our online.

Follow these quick steps to. Wait until Nebraska Inheritance Tax Worksheet is ready. Suite 200 Lincoln NE.

Stick to these simple guidelines to get Nebraska Probate Form 500 Inheritance Tax prepared for sending. 0 Read more grader help How Can I Help. The following tips will allow you to fill out Nebraska Inheritance Tax Worksheet Form easily and quickly.

Because of the complexity of estates this Self-Help. Although Nebraska does not currently have an estate tax it does still impose an inheritance tax. To claim the NHTCs this worksheet must be completed along with the Nebraska Incentives Credit Computation Form 3800N and attached to your income tax financial institution tax or.

Up to 25 cash back Close relatives pay 1 tax after 40000. Douglas County Nebraska Inheritance Tax Worksheet. 402 475-7091 Toll Free 800 927-0117 Fax 402 475-7098.

REG-17-001 Scope Application and Valuations. The best way to change nebraska inheritance tax worksheet form online. Unlike a typical estate tax Nebraska inheritance tax is measured by the value of the portion of a decedents estate that will be received by a beneficiary.

Certificate of Mailing Annual Budget Reporting Forms. 00101 Nebraska inheritance tax applies to bequests devises or transfers of property or any other interest in trust or otherwise having. Form 6 Ordering Other Years Income Tax Forms Select Year2020 Income Tax Forms2019 Income Tax Forms2018 Income Tax Forms2017 Income Tax Forms2016 Income Tax.

Open the document in the full-fledged online editor by hitting Get form. Settling an estate can be complicated and completion of the Inheritance tax form and Probate Inventory Worksheet can be difficult. Property at the date of death.

Beneficiaries inheriting property pay an inheritance tax over. Nebraska State Bar Association 635 S. An inheritance tax worksheet must be completed essentially an inheritance tax return and an effort made to.

In some estates this may require appraisals. The Nebraska inheritance tax applies to an individual who 1 dies a resident. Multiplication Worksheets For Grade 3 4th Grade Math Worksheets 7th Grade Math Wor.

Get the form you require in the library of legal forms. The burden of paying Nebraskas inheritance tax ultimately falls upon those who inherit the property not the estate.

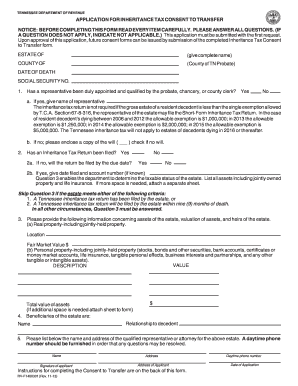

Inheritance Tax Waiver Form Tennessee Fill Out And Sign Printable Pdf Template Signnow

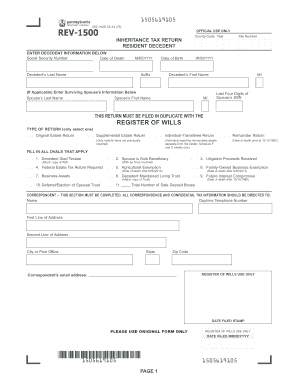

Pa Rev 1500 2019 2022 Fill Out Tax Template Online

Who Pays Inheritance Taxes Executor Duties 101 Executor

Does Nebraska Have An Inheritance Tax Hightower Reff Law

The Nuts And Bolts Of Nebraska S Inheritance Tax Mcgrath North A Client Driven Law Firm Supporting Business In Nebraska The Midwest And Across The Country

Death And Taxes Nebraska S Inheritance Tax

How To Pay Inheritance Tax With Pictures Wikihow Life

Nebraska Estate Tax Everything You Need To Know Smartasset

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Psv05 Creating The Tax Worksheet Youtube

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

How To Pay Inheritance Tax With Pictures Wikihow Life

Can An Estate Deduct Paid Inheritance Tax

Probate Form 500 Fill Out Sign Online Dochub

Form 6 Fillable Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales 8 2012

Inheritance Tax Basics Edge Magazine

Does Nebraska Have An Inheritance Tax Hightower Reff Law

Do I Need To Worry About Inheritance Tax In Missouri St Louis Estate Planning Attorneys

:max_bytes(150000):strip_icc()/inheritance_tax-185234580-58bc7c225f9b58af5c8df46c.jpg)